U.S. ZIP Codes by Median and Average Household Incomes

| ZIP | Household income | Children under 10 | ||

|---|---|---|---|---|

| Median | Average | Total population | % of population | |

Source: U.S. Census Bureau American Community Survey 2023

A powerful financial head start is coming for America’s next generation.

With a historic private donation paired alongside a new federal pilot contribution, eligible children born between January 1, 2025 and December 31, 2028 may receive early seed money inside newly created Trump accounts.

This leads to one pressing question for families: What are the Trump accounts eligibility rules?

This article breaks down exactly who qualifies for the new tax-advantaged savings account, including the $1,000 seed money, and how these investment accounts are designed to build long term financial security.

You might be asking when do Trump accounts start as details emerge. This guide serves as your central resource on the Trump account for kids, explaining how it turns policy into real-world opportunity for your child’s American dream.

Short Summary

- Trump accounts allow families to open a long-term tax-advantaged savings account for children, starting early and growing over time.

- Eligible children may receive federal seed money, with some qualifying for added ZIP code-based funding.

- Contributions can come from families, employers, and approved organizations, within clear annual limits.

- Funds grow with low annual fees and follow familiar IRA-style rules as the child reaches adulthood.

Understanding Trump Accounts Eligibility Requirements for All Children

Let’s clear up the confusion about who can open one of these powerful new accounts. We will walk through the basic rules, the three levels of benefits, and the crucial age deadlines every parent should mark on their calendar.

Basic Eligibility Requirements for Opening a Trump Account

The foundational rules for Trump accounts’ eligibility are straightforward. Think of them as the universal gatekeepers. First, the child must be under 18. They also need a valid Social Security number.

A parent or legal guardian must be the one to open accounts on the child’s behalf. This isn’t just a bank formality.

It’s a requirement because the Internal Revenue Service oversees these tax-advantaged savings accounts, ensuring all contributions and growth follow specific tax laws. It’s similar to how they manage other retirement accounts.

Three Tiers of Trump Accounts Eligibility Explained

Not all eligible children receive the same benefits. Think of eligibility in three stacked tiers. Each tier adds more potential funds to a child’s account.

Tier 1: Basic Account Access. This is the foundation. If a child qualifies on the basic requirements above, you can open an account and family or employers can contribute. It’s a powerful start.

Tier 2: Federal Seed Money. This is where the $1,000 comes in. It’s an extra layer for kids who meet a specific birth year window (more on that next). Government entities like the Treasury Department provide this initial boost.

Tier 3: ZIP Code-Based Contributions. This is the third layer, fueled by partnerships like the Michael and Susan Dell Foundation. It designates certain children as part of a qualified class for supplemental funds based on location and income.

Remember, these tiers stack. A child could benefit from all three, receiving family contributions, the federal seed, and community-based support into one investment account.

Age and Timing Rules Parents Need to Know

Timing is everything. You must open the account created before the calendar year the child turns 18. Miss that window, and the opportunity is gone. This rule makes a child’s birth year critical.

Children born before January 1, 2025 are eligible for Tier 1 (the basic account) but not for the automatic federal seed money. Why? The seed money, per the Big Beautiful Bill Act, is a pilot for kids born later.

So, a 16-year-old in 2025 can have a child’s Trump account, but a newborn sibling might get the account plus the $1000. The account access is lifelong, but the window to open it closes at adulthood.

How to Qualify for the $1,000 Federal Government Seed Money

This is the headline-grabbing benefit. Let’s get into the specifics of which children get this leg up, the refreshing lack of red tape, and how you actually claim the funds.

Which Children Automatically Qualify for Federal Seed Money

The rule here is beautifully simple. To automatically qualify for the seed money, a child must be a U.S. citizen born between January 1, 2025 and December 31, 2028. That’s the four-year pilot window.

The federal government, specifically the Treasury Department, allocates this as a one-time, automatic contribution. Think of it as a welcome-to-America nest egg for those specific birth years.

No Income Limits or ZIP Code Restrictions

Here’s the groundbreaking part: There are no income tests. The eligible children in those birth years all qualify, full stop. This sets it apart from many means-tested programs. Whether a family is in a penthouse or an apartment,

if their child qualifies by birth date and citizenship, the $1,000 is theirs. Government entities designed this piece to be universal, removing bureaucratic hurdles and making the tax-advantaged savings opportunity truly broad-based.

How Parents Claim the Federal Contribution

You don’t have to fight for it. The claim process is integrated into opening the account. When you fill out the official IRS form to establish your child’s account, you’ll indicate the child’s birth date. The system then flags their account created for the seed money deposit.

A crucial tip for parents: this $1,000 does not count toward the $5,000 annual contribution limit. It’s a bonus on top. So, if you add $5,000 from family gifts, the account could start with $6,000 in year one.

Always confirm the latest annual contribution limit, but know this seed money is a separate bucket.

We Guide People How To Invest In Real Estate

ZIP Code-Based Eligibility for Michael and Susan Dell Foundation Contributions

Beyond the federal seed money, a separate layer of potential funding exists. This initiative focuses on geography and community needs.

Who Qualifies for ZIP Code-Based Contributions

The Dell Foundation steps in with a helpful boost for kids who just missed the federal program’s birthday cutoff. Think of it as a catch-up grant. This $250 is specifically for eligible children age 10 and under who were born before 2025.

The foundation uses a brilliantly simple rule to get this money to the right families. If a child lives in a ZIP code where the median household income is $150,000 or less, they qualify. That’s it. No complicated forms, no digging up tax returns for the foundation.

This neighborhood-focused approach is a game-changer for access. It cuts through red tape and lets support flow directly to communities.

In fact, this smart filter means roughly 80% of American children can potentially benefit from this head start, all based on a straightforward ZIP code check.

Pro Tip

How to claim your boost in 2026:

1. For Newborns (2025-2028): File IRS Form 4547 with your taxes this coming spring to claim the $1,000.

2. For Older Kids (Age 10 & Under): Watch for the launch of trumpaccounts.gov on July 4, 2026, to register your child and trigger the $250 ZIP code-based grant.

The Income Threshold

Here’s the good part for families. The gift is tied to your community’s median income, not your personal household income. If you live in a qualifying ZIP code, your individual salary doesn’t disqualify your child.

This is because the Dell contribution is a “Qualified General Contribution.” It goes to every child in a defined, qualified class, specifically, all kids 10 and under in that ZIP code.

The Age Limit

The child must have been 10 years old or younger on July 4, 2025, the date the Big Beautiful Bill Act was signed. This smartly targets children born between 2015 and 2024, a group that otherwise wouldn’t qualify for the newer federal $1,000 seed money for newborns.

How to Check Your Specific ZIP Code

Since a master list doesn’t exist (as of December, 2025), you can check your ZIP code’s status using the same public data the program relies on.

Find Your Zip Code’s Median Household Income

You can use our data table and search for your ZIP code or use the U.S. Census Bureau’s American Community Survey (ACS) data.

Finding out if your ZIP code qualifies is straightforward. You just need to check one key number from the most reliable source. Let’s walk through the simplest ways to get it.

Method 1: Use Our Zip Code Income Search Tool

Use our data table above to search by ZIP code and instantly verify income levels in your region to determine your eligibility.

Method 2: Verify via Official Census Data

For the definitive number, go straight to the U.S. Census Bureau. Their American Community Survey data is what programs use.

Option A: The U.S. Census Bureau

- Visit data.census.gov.

- In the search bar, try a phrase like “Median household income 90210.”

- Look for the table titled “S1901: Income in the Past 12 Months.”

- Be sure to select the “ACS 5-Year Estimates” dataset for your search, as it’s the most complete for ZIP codes.

Option B: Census Reporter

If government sites feel a bit technical, there’s the Census Reporter. It’s an independent, trusted tool that makes Census data easy.

- Just enter your ZIP code on their homepage.

- Scroll to the “Economics” section.

- You’ll see the Median Household Income displayed clearly, often with helpful comparisons.

Two Crucial Details to Get Right

When you find the number, keep these tips in mind:

- Look for “Household” Income: Ensure the table says “Household,” not “Family” income. This is the standard measure.

- Check the Dollar Year: Verify the data is labeled as “Inflation-Adjusted” to the current year (like 2024 or 2025). This ensures you’re correctly applying the $150,000 threshold.

Apply the Rule

If the median household income for your ZIP code is $150,000 or less, children aged 10 and under there qualify for the $250 contribution. Remember, this is based on the area’s median income, not your personal household income

Find out more here: https://www.trumpaccounts.gov/

Think of it as a targeted boost for certain communities. If all boxes are checked, supplemental funds can flow into the child’s investment account.

What “Qualified Class” Status Means for Contributions

This is key jargon. When a child is part of a qualified class, it’s a legal designation. It simply means they fit a specific group profile defined by the program. This status is the magic wand.

It allows nonprofit organizations like the Dell Foundation and even state government entities to make additional contributions to these accounts. These contributions are separate from the annual family cap.

So a child could get a $500 community contribution plus $5,000 from family in the same year.

Why These Contributions Target Long-Term Wealth Gaps

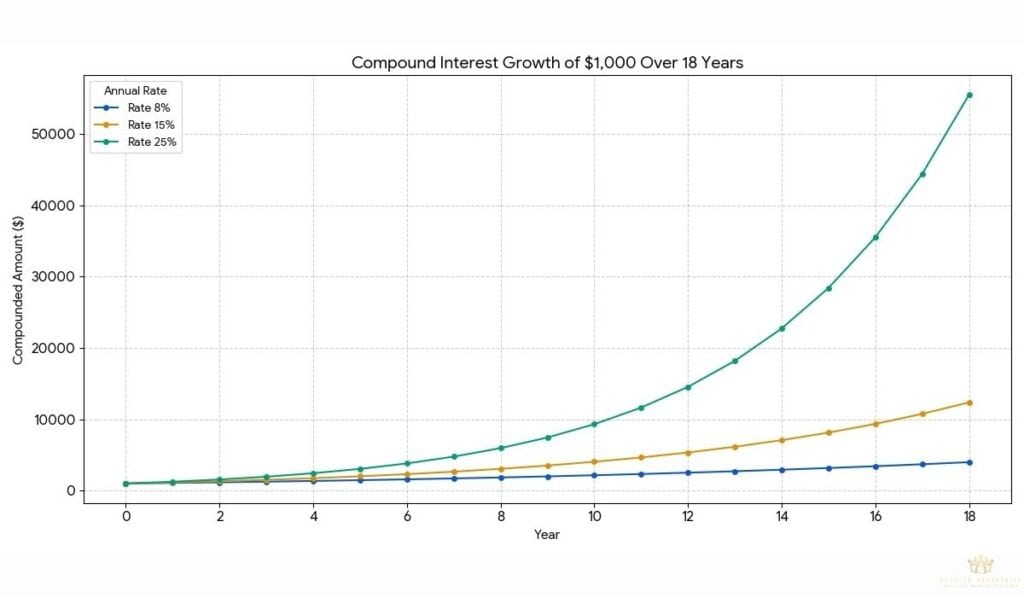

This isn’t random. Research informs the approach. A study from the Urban Institute highlighted how early asset-building can alter life trajectories. By targeting communities with specific economic profiles, these contributions aim to plant seeds for long-term financial security.

The goal is to help level the playing field for the next generation, using data-driven methods to address wealth gaps.

How Trump Accounts Work as Tax-Advantaged Investment Vehicles

Let’s talk mechanics. Once open, how does this investment account actually function? We’ll cover the life cycle, investment choices, costs, and rules.

How Trump Accounts Function Before and After Age 18

Understanding how Trump accounts work is straightforward. Before 18, the parent or guardian manages the account. They choose investments from a curated menu. When the child turns 18, control shifts.

The accounts function differently then. They automatically convert into a traditional IRA governed by standard IRA rules. This seamless transition turns a childhood savings tool into an adult retirement account.

Investment Options Inside a Trump Account

You won’t be picking individual stocks. The law limits choices to broad, diversified options. This protects the long-term financial security goal. The menu includes:

- Mutual funds: Professionally managed pools of stocks and bonds.

- Exchange traded funds (ETFs): Similar to mutual funds but trade like stocks.

- Equity index funds: These track a specific stock market index, like the S&P 500.

The idea is to keep the investment strategy simple and growth-oriented. The money is invested for the long haul.

Fees, Growth, and Tax Treatment Explained

Let’s demystify costs and taxes.

Annual fees are capped by law at 0.1%. That’s just $1 per year for every $1,000 saved. All investment gains grow tax free inside the account. That’s a huge advantage.

The tax treatment on withdrawals is like a standard IRA: funds are taxed as ordinary income when taken out in adulthood.

Contribution Rules for Employers and Family Members

Here’s how money gets in. Employers can contribute directly to an employee’s child’s account, up to $2,500 yearly. Family members can also gift money. All these additional contributions share one annual contribution limit.

For 2025, the total limit is $5,000 per child. So, if grandparents contribute up to $2,500 and an employer adds another $2,500, that maxes it out. Everyone works toward the same annual contribution cap.

Withdrawal Rules and Long-Term Planning Considerations

The same IRA withdrawal rules apply later in life. Withdrawals before age 59½ typically incur a 10% penalty plus taxes. Non-qualified withdrawals are costly, eroding the full balance.

The account is designed for major life goals: a first home, higher education expenses, or retirement. Consulting a financial advisor for personal guidance is always wise.

Final Thoughts

These accounts turn a complex policy into a simple, powerful tool. They provide a real pathway toward the American dream and long-term financial security for kids. Remember, tax laws can shift.

A quick chat with a financial advisor is a smart move. Trusted financial experts can help you navigate your specific plan.

Ready to take the next step? Explore more straightforward guides and tools on our homepage to continue building your family’s future.