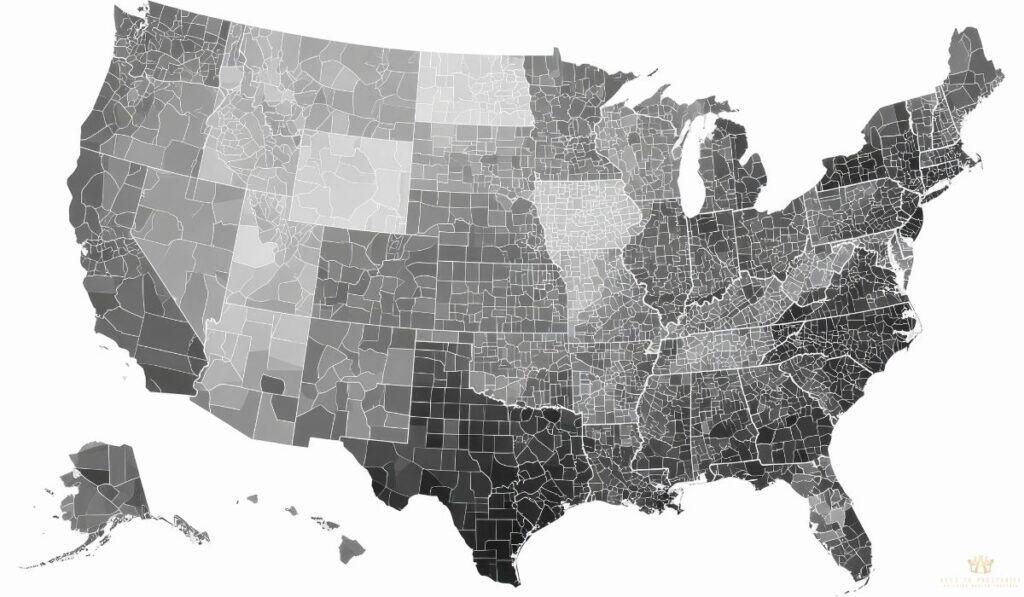

U.S. ZIP Codes by Median and Average Household Incomes

| ZIP | Household income | Children under 10 | ||

|---|---|---|---|---|

| Median | Average | Total population | % of population | |

Imagine starting your child’s financial future with a $1,000 seed money gift from the federal government. That’s the powerful opening move available for eligible children born into the pilot program.

We’re talking about the Trump account for kids, a revolutionary tax-advantaged vehicle. From our experience, a consistent strategy can transform that start into a six-figure advantage by adulthood. This guide walks you through exactly how to maximize these accounts.

This post focuses on growing that initial seed money. For more on the program’s origins, see our breakdown of the big beautiful bill.

To explore related big beautiful bill real estate investors’ benefits, stay tuned for our next article. We’ll also cover the big beautiful bill SALT cap in a separate piece.

Short Summary

- Trump accounts give families a structured way to turn early contributions into meaningful investment growth over time.

- Built-in rules keep investments focused on broad U.S. markets and long-term outcomes.

- Consistent contributions, even small ones, can make a major difference across 18 years.

- Planning ahead for withdrawals helps protect options for education, housing, or future savings.

Comparison of Educational Fund Investments

| Feature | New in 2026 | Traditional | ||

|---|---|---|---|---|

| Trump Account | Dell Match | 529 Plan | Coverdell ESA | |

| Effective Date | 5-Jul-26 | 5-Jul-26 | 1998 | 1998 |

| US Government Contribution? | Yes | Yes | No | No |

| Company Match Allowed | Yes | No | No | No |

| Maximum Age Limits | TBD | TBD | Unrestrictive | Age 30 |

| Median Income Restriction | No | Yes | No | No |

| US Gov Contribution Amt | $1,000 | $250 | N/A | N/A |

| Annual Max Contribution | $5,000 | N/A | $19,000 | $2,000 |

| Tax Exempt Earnings | Yes | Yes | Yes | Yes |

| Tax Exempt Withdrawal | Usage based | Usage based | Usage based | Usage based |

| Investment Restrictions | Yes | Yes | Yes | Self-directed |

| Transferrable (Siblings) | No | No | Yes | No |

| Maximum Account Balance | No | No | $500,000 | No |

| Usage Restrictions | Yes | Yes | Yes | Yes |

| Custodian at Age 18 | Beneficiary | Beneficiary | Parent/Guardian | Beneficiary |

| One-time Max Contribution | N/A | N/A | $190,000 | N/A |

The 2026 Toolkit: Integrating Trump Accounts with 529s and ESAs

With the long-term rules in mind, let’s build your proactive plan. The smartest approach for 2026 is a triple-threat strategy. By using each account for its unique strengths, you can maximize free money, tax-advantaged growth, and estate protection.

Remember, while planning starts now, no Trump Account can be activated or funded until after July 4, 2026. This is your preparation window.

The smartest approach to 2026 is a triple-threat strategy. By using each account for its unique strengths, you maximize free money, tax-free growth, and estate protection.

Step 1: Claim Your “Free” Capital First

- The Federal $1,000 Seed Grant: For children born 2025–2028. This is a direct cash deposit. File IRS Form 4547 with your tax return to pre-register.

- The Dell Foundation $250 Gift: For children 10 and under (born before 2025). This targets ZIP codes with a median income of $150,000 or less. Verify your ZIP on trumpaccounts.gov after July 4.

- The Tax-Free Employer Match: Under Section 128, employers can contribute up to $2,500/year per employee. This is tax-free to you and counts toward the child’s $5,000 annual limit.

- The Tax-Free Employer Match: Employers can contribute up to $2,500 per year per employee. These funds are excludable from your gross income (you don’t pay taxes on them) and count toward the child’s $5,000 annual limit.

Step 2: Comparison Table

|

Feature |

Trump Account |

529 Plan |

Coverdell ESA |

|---|---|---|---|

|

General Wealth / First Home |

Massive Education Savings |

Full Investment Control | |

|

$5,000 |

No Limit (up to Gift Tax) |

$2,000 | |

|

Ends Dec 31 before age 18 |

No Limit |

Ends at Age 18 | |

|

No Limit (Converts to IRA at 18) |

No Limit (Lifetime) |

Must spend by Age 30 |

Step 3: Navigate the “Age Trap”

The “Age Trap” isn’t just about taxes; it’s about who holds the keys to the account.

- The Coverdell ESA has a “use-it-or-lose-it” pressure. If the money isn’t spent by age 30, it’s distributed and taxed.

- The Trump Account automatically transitions. On January 1st of the year the child turns 18, the child gains full control. The funds belong to them and their discretionary spending habits.

- The 529 Plan is the Control Champion. As the custodian, you retain 100% power over distributions regardless of the child’s age.

If one child decides not to go to school or isn’t ready for the money, you can transfer the funds to another child (or even yourself) tax-free.

Advanced Strategy: The 529 Plan as an Estate Tax Shield

For high-net-worth families, the 529 plan is the ultimate 2026 toolkit item because it allows you to move massive amounts of cash out of your taxable estate instantly.

- The Power of Superfunding: The 2026 annual gift exclusion is $19,000 per person. The IRS allows you to “front-load” five years of these gifts into a 529 in a single day. This means an individual can move $95,000, and a married couple can move $190,000 per child, out of their taxable estate instantly.

- The Divorced Parent Advantage: Because the $19,000 limit is per donor, divorced parents have a unique edge. Since they file separately, each parent can contribute their own maximum. Together, they can shift $38,000 annually ($19k each) into their child’s 529. If they both choose to superfund in 2026, they can move a combined $190,000 into the child’s future in a single year.

- The Grandparent Multiplier: This is where the 2026 Toolkit becomes truly formidable. If four grandparents also contribute their individual maxes ($19,000 each), you could potentially shift an additional $76,000 annually into that same child’s fund.

- The Total Shield: In a single year, a coordinated family (parents and grandparents) could theoretically move over $220,000 per child into 529s. In states like Maryland, where the estate tax kicks in at $5 million, this is the most effective way to move wealth under the taxable line while keeping the state’s hands off your legacy.

By building this coordinated 2026 Toolkit, you’re not just saving. You’re executing a sophisticated wealth-building plan that leverages every new opportunity and time-tested rule to its fullest.

Maryland residents can subtract up to $2,500 per child from their state taxable income. If you’re divorced, each parent can claim their own $2,500 deduction on their separate returns—doubling the state tax benefit.

Planning to “superfund” $95,000 this year? Don’t worry about “wasting” the deduction. Maryland is one of the few states that lets you carry that tax break forward for 10 years until every cent of your contribution is accounted for.

Eligibility & Seed Money: Understanding Zip Code Rules and Prior Birth Years

First, let’s clear up exactly who gets what.

It’s crucial to separate two distinct pots of free money for Trump accounts: the federal government’s contribution and a separate private charitable grant. The rules for each are very different.

The Federal $1,000 Seed Money

For the federal government’s one-time $1,000 deposit, eligibility is straightforward and universal. Any child who is a U.S. citizen with a valid Social Security number and is born between January 1, 2025, and December 31, 2028, qualifies for the full amount.

There are no income restrictions, no ZIP code requirements, and no state median income tests for this seed money. It is available to every eligible newborn.

The Dell Foundation $250 Charitable Grant

A separate, private gift from Michael and Susan Dell provides a different opportunity. This $250 grant is for older children who aren’t eligible for the federal $1,000, specifically, those age 10 and under who were born before January 1, 2025.

For this Dell grant, ZIP code and income restrictions do apply. A ZIP code does not qualify if its median household income is above $150,000. This grant is designed to provide a head start to children in low- and middle-income communities.

In summary:

For older kids (born before 2025): Potential $250 Dell grant. Disqualification occurs if the child’s ZIP code median income exceeds $150,000.

For newborns (2025-2028): Universal $1,000 federal seed money. No location-based disqualifications.

Always verify. The governing IRS form will have clear guidelines. Don’t assume; check the official upcoming regulations.

This ensures you know exactly what money your child’s savings account will start with.

Tip: Use our data table above to search by ZIP code and instantly verify income levels in your region to determine your eligibility.

Understanding Your Child’s Trump Account Investment Options Within Federal Guidelines

Let’s demystify the investment engine inside your child’s Trump account. This isn’t a standard brokerage. Think of it as a guided, protective framework for long-term savings.

So, how do Trump accounts work for investing? The rules focus on safety and growth for American children.

The Treasury Department mandates that all funds must track broad, diversified U.S. market indices. You can’t pick individual stocks. This investment account is designed for steady, tax deferred growth. The program’s guardrails are its best feature.

- American Equities Only: Every dollar stays within the U.S. stock market.

- No Leverage: This bans risky bets with borrowed money.

- Capped Annual Fees: Providers keep costs minimal, protecting your compound growth.

You’ll choose from treasury department-approved options, primarily exchange-traded funds (ETFs) and mutual funds. What’s the practical difference? ETFs trade like stocks all day. Mutual funds price once after close.

Both are excellent for this tax deferred investment vehicle. We often see parents get stuck on this choice. Our guidance? Focus on the low fees and broad index tracking, not the product type.

This structure reduces wild risks and turns the account into a powerful savings account for the future.

Remember, you’ll need an IRS form to designate the account. Always check for upcoming regulations from the internal revenue service for any tweaks. These rules might seem strict, but they turn the account into a set-it-and-forget-it growth tool.

As one policy expert noted, “These constraints are the point—they prevent speculation and keep the focus on the child’s future.”

We Guide People How To Invest In Real Estate

Maximizing Contributions: How Employers, Family Members, and the Government Build Wealth

The federal seed money is a fantastic launch. But real momentum comes from yearly contributions.

Let’s break down the rules. The total annual contribution limits are strict: $5,000 annual per child. Every dollar from every source must count toward the 5,000 limit each calendar year.

Who can Pitch in?

The list is surprisingly flexible.

- Parents, family members, or even friends can contribute.

- Employers can make additional contributions as a benefit for an employee’s dependent.

- The child can add their own earned income.

All contributions use after tax dollars. There is no upfront tax deduction. Now, picture two paths.

- Path one: only the initial $1,000.

- Path two: maximizing the $5,000 annual limit every year.

The difference after 18 years isn’t just large; it’s life-changing. This is where that head start becomes a massive lead.

How do Employer and Charitable Gifts Work?

Imagine a local business offering a 401(k)-style match for their employees’ kids’ accounts. That’s possible. Charitable donations can also flow in. A famous case is the Michael and Susan Dell Foundation.

Their model shows how philanthropic money can help a qualified class of children. Susan Dell has emphasized how such investments “create a free press of opportunity.” This isn’t a theoretical White House idea. It’s a practical tool.

So, how do you make the most of it? We advise families to treat it like a non-negotiable bill. Automate what you can. Grandparents can give this instead of a toy. Even small, regular additional contributions add up dramatically. The key is consistency.

Let that money work hard in the market, undisturbed. Every dollar that doesn’t count toward this year’s limit is a lost chance for tax-advantaged growth. Don’t let that happen.

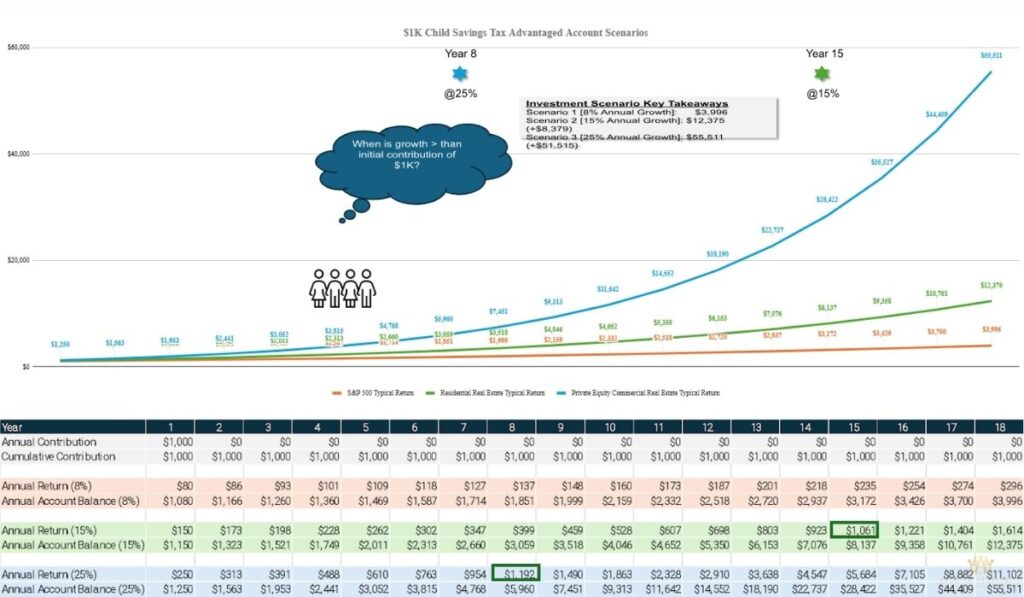

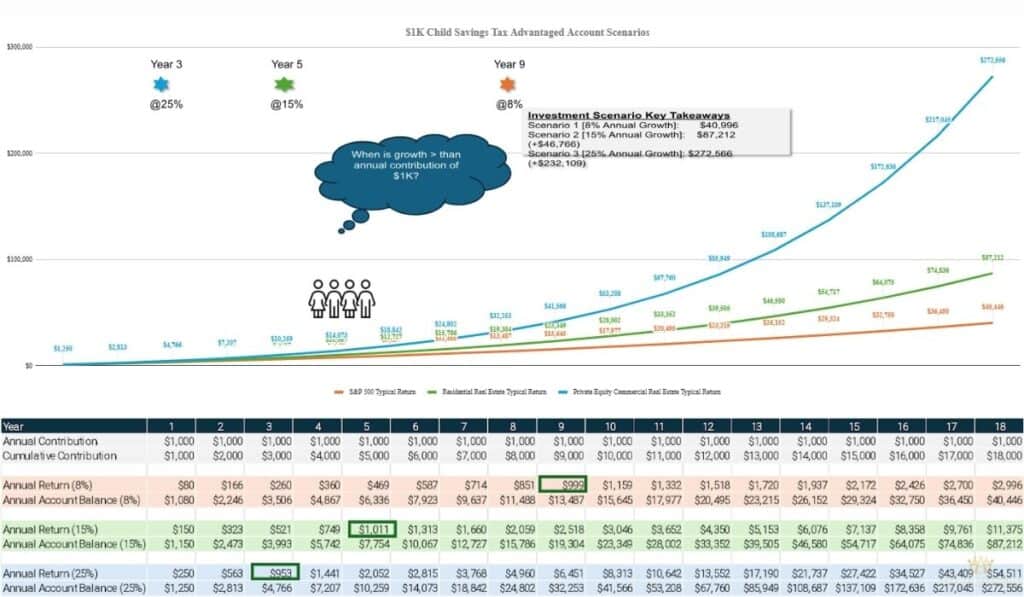

The Power of Compound Growth: Visual Breakdown of Trump Accounts Over 18 Years

Compound growth is your child’s silent financial partner. It means earnings generate their own earnings. The tax deferred nature of this tax advantaged account makes that process incredibly efficient. Let’s see what that math actually looks like.

Three-scenario compound growth chart at 8%, 15%, and 25% annually.

Consider that initial $1,000 seed money alone. At a conservative 8% annual return, it grows to about $4,000 in 18 years. Not bad, right?

At a more optimistic 15%, it balloons to over $12,000. Now, the exciting part. The entire account benefits from this investment growth, not just the seed. Add yearly contributions and the numbers get serious.

How does this compare to a traditional IRA? The tax-deferred investment vehicle structure is similar. Traditional IRA rules also let funds grow without annual tax drag.

The key difference? Anyone can contribute to a child’s Trump Account, not just those with earned income. This is a huge advantage for accounts started at birth.

- Scenario 1 (8% return): Steady, historically aligned with broad stock market index growth.

- Scenario 2 (15% return): More aggressive, requiring a focused portfolio.

- Scenario 3 (25% return): Very aggressive, highlighting maximum potential.

The lesson is simple. Starting at birth gives time the most potent role. As Warren Buffett famously said, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.” Your child’s account can harness that same power.

The Power of “Tax-Free” in Action

Let’s talk about tax-free growth, and what does that actually mean for your child’s long-term financial security? Let’s make it real. This table shows a hypothetical, yet powerful, example.

Imagine starting with just the $1,000 federal seed money at birth and adding a simple $1,000 family gift at the start of every year.

We’re assuming a 12% annual return, which is a common long-term average for broad stock market investments like equity index funds, and that all earnings compound tax free inside the account.

Here’s where it gets even more powerful: While this example uses $1,000, the actual law allows total annual contributions of up to $5,000 per child from family. An employer can chip in an extra $2,500. Using the full limit would dramatically accelerate this growth.

Future Value Formula (Ordinary Annuity)

FV = P x ((1 + r)^n – 1) / r

Where:

n = years

P = 1,000

r = 0.12

| Year | Annual Contribution | Total Contributions | Account Value |

| 1 | $1,000 | $1,000 | $1,000 |

| 5 | $1,000 | $5,000 | $6,352 |

| 10 | $1,000 | $10,000 | $17,549 |

| 15 | $1,000 | $15,000 | $34,102 |

| 20 | $1,000 | $20,000 | $72,052 |

| 22 | $1,000 | $22,000 | $99,246 |

| 23 | $1,000 | $23,000 | $112,155 |

Remember: This is a theoretical projection for illustration. Actual returns will vary based on market performance, specific investments, and fees.

See the magic? By the child’s 23rd birthday, total contributions of $23,000 could grow to over $112,000. That’s the exponential power of consistent saving, compound growth, and a tax-advantaged structure working together for decades.

This is the core math behind building that American dream foundation.

Finally, the $5,000 contribution cap is indexed for inflation after 2027. This means the real amount families can save, and the potential size of that foundation, could grow even larger in the future, which truly future-proofs the opportunity.

Strategic Withdrawal Planning: Converting Your Trump Account to Long-Term Wealth After Child Turns 18

What happens when your child turns 18? The account transitions. Standard IRA rules then govern it. This is a critical juncture for long-term savings. Understanding the rules prevents costly mistakes.

The key change involves tax. Upon any withdrawals applied, the distributed amount is treated as ordinary income. This means the child pays income tax at their rate. So, what’s the smart move? We generally see two paths.

Path A: Qualified, Goal-Oriented Withdrawals

The law encourages using this money for foundational wealth building. Withdrawals apply without penalty for:

- Higher education expenses (tuition, books, room, board).

- A first-home purchase (up to a lifetime limit).

- Rolling funds into a retirement account for later date use.

Path B: Long-Term Continuation

The child simply lets the account continue growing. This choice can fuel their own American dream or help the next generation. Research from the Urban Institute highlights how early capital access dramatically increases lifetime wealth. This account is that capital.

Think of it as a major financial decision point at age 18. Do you use this resource now for a major goal, or let it compound for decades more? There is no single right answer, but there is a right framework for the discussion.

For some families, pairing this with an able account for disability expenses may also be relevant. The goal is intentional, not accidental, use of this resource.

Final Thoughts

Building wealth for kids does not require complicated moves. It starts with steady habits, patience, and smart use of accounts designed for growth.

These plans support long term savings, offer tax advantaged benefits, and give families a real shot at meaningful investment growth. We see this as more than numbers on a page.

It‘s about creating options for American children and setting up the next generation with confidence and flexibility tied to the American dream. Guidance from a trusted financial advisor can help match goals with action.

Ready to take the next step? Visit our homepage to explore tools, resources, and deeper insights.