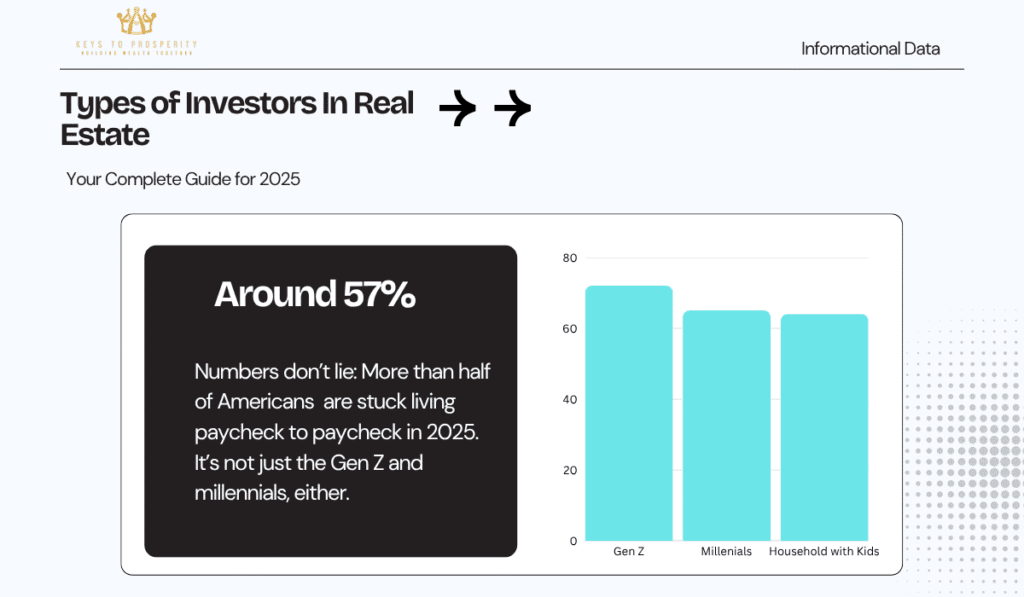

As someone once said, the numbers don’t lie: More than half of Americans (around 57%) are stuck living paycheck to paycheck in 2025. It’s not just the Gen Z and millennials, either.

The data shows everyone’s feeling the squeeze.

Rising costs, especially housing (which has jumped 122% since 2002), have made it tough to build wealth the traditional way. From our experience, real estate investing can be a practical and powerful step toward financial freedom.

Don’t think, however, that all investors start the same way—or end up in the same place.

This guide breaks down the types of investors in real estate, from those just getting started with residential properties or real estate investment trusts to major players like institutional investors handling commercial real estate assets.

We’ll cover common investment strategies, how to match them with your risk tolerance, the capital needed to begin, and where you might fit in.

You’ll also learn how to spot potential investment opportunities, what to consider when comparing a fixed vs variable rate commercial mortgage, and how to move from scraping by to actually building a property portfolio—one step at a time.

Short Summary

Over half of Americans live paycheck to paycheck, limiting investment potential—but real estate remains a viable wealth-building path.

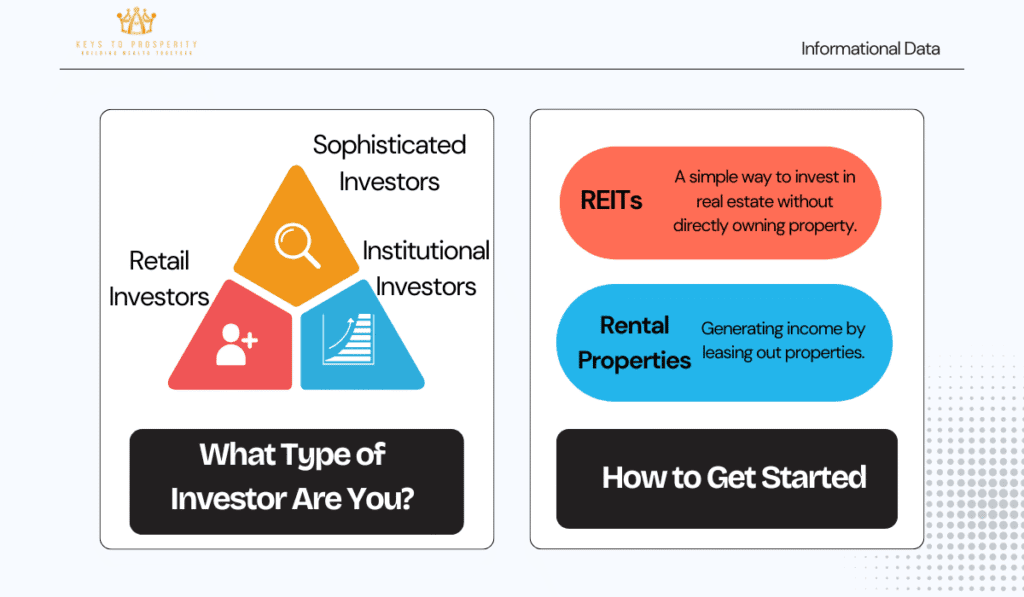

Investors fall into categories like retail investors, sophisticated investors, accredited investors, and institutional investors, each with distinct strategies, capital requirements, and access levels.

Your risk tolerance, financial goals, and time horizon should guide your real estate investment approach.

Starting with REITs or rental properties allows beginners to move from financial instability toward long-term property ownership with as little as $25K in cash.

Each step—from initial investing to portfolio diversification—can align with your current situation and help you grow wealth steadily.

The Current Real Estate Investment Landscape And American Financial Reality

Understanding where Americans are putting their money, and why many feel stuck, is key to knowing how real estate fits in. Let’s break it down: where investments go, who’s investing, and how real estate investing can be a lifeline when your paycheck barely stretches past the bills.

Investment Distribution Across Asset Classes

Most Americans still lean on traditional routes like stocks and ETFs. Roughly 61% of U.S. adults own stock, but only about 15% own investment real estate. Crypto peaked in buzz a few years ago, but fewer than 12% hold any digital assets today.

We’ve noticed newer investors often start with what feels familiar, like index funds or apps like Robinhood, then gradually diversify once they get more confident.

As a general rule, allocating 25% of your portfolio to real estate can provide long-term stability, especially if you’re saving toward a $100K investment goal.

While building savings, consider investing in S&P 500 ETFs, which offer an 8-10% ROI to grow your capital.

Real Estate Vs. Stocks, ETFs, And Crypto

From what we’ve seen, people usually shift to real estate investments after realizing stocks can swing wildly and crypto’s even more unpredictable. A typical diversified portfolio has 25% allocated to real estate for stability and growth.

We’ve walked through this strategy with folks who initially went all-in on crypto and later rebalanced into tangible assets after feeling the volatility.

The Paycheck-To-Paycheck Crisis Breakdown

Now, here’s the tough part. About 57% of Americans live paycheck to paycheck. It’s worse for some:

- 72% of Gen Z

- 65% of millennials

- 64% of households with kids

That kind of pressure makes investing feel impossible. But it’s not about being wealthy. It’s about building smart habits with the right tools.

In today’s dollars, to get into real estate investing, you need a minimum of $25K, which may be tied up for 5-10 years. This could cover a down payment on a $150K single-family rental with a 20% down payment loan.

How Rising Costs Impact Investment Capacity

Housing costs are up 122% since 2002, while wages haven’t kept up. Families with decent incomes still struggle to set aside anything for investing.

It’s not rare for a couple to spend nearly 50% of their monthly income on housing, leaving little room to grow their future.

Real Estate As A Wealth-Building Solution

Real estate investing offers control, cash flow, and leverage. Unlike stocks, it doesn’t vanish in a flash. Rental income, property appreciation, and tax advantages make it a practical escape route.

Even a small rental property can shift the needle financially. For those starting out, REITs or rental properties are accessible entry points that appeal to the masses, requiring minimal capital compared to other investments.

Market Size And Accessibility

The U.S. commercial real estate market alone is worth trillions. Between REITs, house hacking, and short-term rentals, the entry points have never been more flexible.

We always recommend beginners explore local duplexes or small multifamily homes. They’re easier to manage and offer solid returns, especially with a minimum of $25K for a down payment on a $150K property.

Types Of Investors in Real Estate: Understanding Your Category

Getting into real estate investing starts with knowing what kind of investor you are, or plan to be. Whether you’re just testing the waters or managing millions in assets, each category comes with different opportunities, responsibilities, and access points.

Retail Investors

Starting small with your own savings? You’re likely a retail investor, typically working with less than $50K–$100K in investable assets. This group often uses traditional trading platforms like Robinhood to buy single-family rentals, flip properties, or invest in REITs. Common strategies include:

- Buying a long-term rental in a growing neighborhood most retail investors manage budgets under $500K, focusing on steady income and moderate risk, often leveraging side income to scale up.

- Living in one unit of a duplex and renting the other (house hacking)

- Starting with as little as $50 in a REIT portfolio

Sophisticated Investors

Sophisticated investors aren’t defined by wealth but by knowledge. As they educate themselves about alternative investments, they may work with $50K to $1M or more. They understand risk, evaluate returns independently, and often self-manage deals without heavy reliance on advisors. Their strategies include:

- Backing early-stage developments or commercial rehab projects

- Joining private investment groups or 506B syndications (private opportunities)

- Using creative financing to scale faster access to deals grows from about 25% as a retail investor to 50% as a sophisticated investor, boosting potential returns.

Accredited Investors

Accredited investors meet strict financial criteria:

- $200K+ annual income (or $300K for joint filers)

- $1M+ in net worth, excluding a primary residence with investable assets often at $1M+, they access traditional platforms, 506B syndications, and public offerings like venture capital or large multifamily deals. Shifting from sophisticated to accredited status increases deal access from 5% to 10%, with average returns often exceeding 20% ROI. This group can reinvest profits to unlock up to 75% of high-value opportunities, significantly accelerating wealth growth.

Angel Investors

Angel investors bridge experience and access, often funding early-stage developments, tech-driven property startups, or unique housing models. They operate independently, bringing more capital and strategy than retail investors but less scale than institutions. Some invest passively in commercial properties with strong upside, while others take hands-on roles in projects they believe in, balancing risk and innovation.

Institutional Investors

Institutional investors are the powerhouses—pension funds, REITs, private equity firms, and insurance companies managing billions. They target large apartment complexes, Class A commercial spaces, and strategic developments in major metros. With teams of analysts, property managers, and acquisition experts, they optimize returns and operate at a national or global scale, far beyond the reach of individual investors.ms optimize properties for maximum long-term return and operate at national or global scale.

How Fast Can You Become an Accredited Investor?

The journey from retail to accredited investor is about building wealth and knowledge. Starting as a retail investor with 25% of your portfolio in real estate (e.g., REITs or rentals), you can grow your assets through disciplined saving and investing in S&P 500 ETFs (8-10% ROI).

As you transition to a sophisticated investor with $50K-$1M, you access private syndications, increasing your real estate allocation to 50%.

Once you hit accredited status ($1M+), your access to high-return deals (20%+ ROI) allows you to allocate up to 75% to real estate, compounding wealth faster.

This progression not only accelerates your path to accredited status but also helps sustain and grow your wealth.

Investment Strategies And Risk Management By Investor Type

Different investors play the game differently, and for good reason! Your goals, experience, capital, and risk appetite all shape how you approach real estate investing, from passive income to long-term equity growth.

Strategy Alignment With Investor Categories

For residential real estate investors, the focus is usually on building steady cash flow through rental properties. These strategies suit retail investors with $25K-$100K who want predictable rental income and manageable overhead.

For example, one investor bought a duplex with a $30K down payment, hired a property manager, and relied on rental checks to pay off the mortgage.

Commercial real estate tends to attract sophisticated, accredited, or institutional investors due to its complexity and potential scale. Some common income-producing commercial real estate strategies include:

- Purchasing retail strip malls with stable tenants

- Investing in multi-tenant office buildings

- Adding value to older industrial sites in gentrifying neighborhoods

Real Estate Investment Trusts (REITs) For Hands-Off Investors

If you’d rather stay hands-off, REITs offer real estate exposure without the headaches of direct ownership. These are ideal for retail investors with limited capital (as low as $50) or low risk tolerance.

Newer investors opt for REITs when they’re unsure about local market dynamics or want broad diversification. It’s a solid first step before diving into physical properties requiring $25K or more.

Risk Tolerance And Investment Objectives

Understanding your comfort level with risk helps narrow your approach.

- Lower risk tolerance: mutual funds with real estate exposure, REITs, and hiring property management for passive returns

- Higher risk tolerance: undervalued buildings in weaker markets, student housing, or undeveloped raw land in growth corridors

Many investors take short-term bets on turnaround projects, but it only worked when backed by deep market knowledge. Accredited investors with $1M+ can leverage high-return opportunities (20%+ ROI) to diversify further.

Market Conditions And Risk Management

Economic cycles play a big role in real estate success. Office space can lag during downturns, while affordable rentals often stay strong.

To manage risk:

- Diversify by location and asset type

- Keep some liquidity

- Monitor tenant demand and local job growth

Balancing long-term strategy with flexibility makes all the difference during market swings.

Climbing The Investment Ladder: From Paycheck To Paycheck To Property Owner

It’s completely possible to go from living check-to-check to becoming a confident property owner. We’ve seen it happen more than once, especially when investors start with small, smart moves and stay consistent.

Breaking The Paycheck-To-Paycheck Cycle

You don’t need a six-figure savings account to begin. One of the most approachable starting points is buying shares in REITs, which require as little as $50.

Alternatively, with $25K in cash, you can make a 20% down payment on a $150K single-family rental, tying up funds for 5-10 years.

Some new investors started with as little as $50 in REIT shares and reinvested dividends until they were ready for something bigger. It’s not overnight wealth, but it builds discipline and a sense of progress.

Step-By-Step: How Most Investors Move Up

A gradual approach can reduce stress and build confidence. Here’s how we typically see beginners grow:

- Step 1: Go from non-investor to retail investor by starting with REITs ($50+) or S&P 500 ETFs (8-10% ROI) while saving toward a $100K portfolio with 25% in real estate.

- Step 2: Make the leap into your first rental property, usually a single-family or small multifamily, with a $25K down payment.

- Step 3: Transition to a sophisticated investor ($50K-$1M) by diversifying into 506B syndications or small commercial units.

- Step 4: Become an accredited investor ($1M+) to access high-return deals (20%+ ROI) through syndications and public offerings, increasing real estate allocation to 50-75%.

- Advanced: Get exposure to institutional real estate by investing through crowdfunding platforms or syndications.

Matching Strategy To Financial Situation

Not everyone starts in the same place, so align your goals with what’s realistic. If capital is limited, lean on income strategies like cash-flowing rentals ($25K minimum) or REIT dividends.

Sophisticated investors ($50K-$1M) can explore private syndications, while accredited investors ($1M+) can target high-return opportunities. Long-term investors build portfolios slowly, adding one property every few years.

Those who stick to their wealth-building roadmap and avoid emotional buying tend to see better returns.

Tools And Pros That Help

We always suggest working with professionals who know your market.

- A real estate-savvy CPA can help optimize taxes

- A financial planner can help you set achievable benchmarks

- Property managers free up your time once you scale

With patience and a plan, it’s possible to turn financial stress into financial freedom, one property at a time.

Final Thoughts

Real estate investing doesn’t have to feel overwhelming. Start small with REITs ($50) or a rental property ($25K), stay consistent, and adjust your strategy as your finances grow.

Most successful investors didn’t start with a lot—they just started. If you’re serious about turning your money into something that works for you, there’s a path forward no matter your budget or background.

Take the next step toward building your portfolio, explore our guides, tools, and tips right from the homepage.

Frequently Asked Questions

What’s The Easiest Way To Start Investing In Real Estate With Little Money?

Many new investors start with REITs or real estate mutual funds, requiring as little as $50 for exposure to income-producing real estate.

A $25K down payment can also secure a $150K rental property.

What’s The Difference Between A Retail And Institutional Investor?

A retail investor (under $100K in assets) uses personal funds, while institutional investors (e.g., hedge funds) invest at scale in markets unavailable to individuals.

How Does My Risk Tolerance Affect My Real Estate Investment Choices?

Lower risk tolerance suits REITs or managed rentals; higher risk tolerance suits turnaround projects or raw land, with accredited investors ($1M+) accessing high-return deals (20%+ ROI).

Can I Really Build Wealth Starting From A Paycheck-To-Paycheck Situation?

Yes, with patience. Start with REITs ($50) or save $25K for a rental property, reinvest profits, and gradually scale to sophisticated ($50K-$1M) or accredited ($1M+) status for higher returns.

How Fast Can I Become An Accredited Investor?

By allocating 25% of your portfolio to real estate and investing in S&P 500 ETFs (8-10% ROI), you can grow from retail to sophisticated ($50K-$1M) to accredited ($1M+), increasing real estate allocation to 50-75% for 20%+ ROI, compounding wealth.