Two-thirds of American adults, about 67%, now find their earnings completely spent before the next payday arrives. This stark percentage of Americans living paycheck to paycheck defines our current financial reality.

From our experience analyzing the data, this squeeze isn’t new, but the pressures of the past year have intensified the challenges for many Americans.

This article breaks down why living paycheck to paycheck is the norm, where the money goes, and what it reveals about America today.

For our readers following our series, we recently explored maximizing an investor salary. Up next, we’ll examine real estate investing risks.

This post serves as a crucial foundation for understanding the economic landscape facing everyday consumers and real estate investors alike.

Short Summary

- Two-thirds of American adults—about 67%—now live paycheck to paycheck, with earnings gone before the next payday hits (percentage of Americans living paycheck to paycheck stays high in 2026).

- The squeeze hits lower income households hardest, but more than half of those earning over $100,000 still report tight cash flow each month.

- Gen X carries the heaviest strain among generations, facing stacked costs like mortgages, tuition, and parent care.

- Only about 30% of adults could cover a $1,000 emergency with cash (Bankrate study), leaving most to dip into credit or cut back.

- Everyday pressures—housing, groceries, health care, shock bills, and inflation—keep budgets volatile, with the Barbell Effect widening the gap between cushioned and stretched households.

Living Paycheck to Paycheck Statistics in the U.S.

The numbers tell a clear story, and they cut across income lines. Below, we break down what the data shows and why the trend keeps spreading.

Current Household Data Across Income Levels

Recent report after report shows the percentage of Americans living paycheck to paycheck remains high across nearly every income tier.

Roughly two-thirds of households living paycheck to paycheck earn under $50,000, which aligns with pressure on lower income households. The surprise comes higher up the ladder.

- More than half of households earning over $100,000 still report tight monthly cash flow

- The overall percentage of Americans living paycheck to paycheck now represents a majority share of working households

For example, we often see dual-income families with solid salaries who miss flexibility once fixed costs lock in the paycheck.

How the Percentage Has Shifted Over Time

When compared with the past few years, the trend continues upward. Internal data aligns with national findings from the federal reserve, showing a steady rise from the past year alone. This change reflects persistence, not a temporary spike.

The Upward Trend: Percentage of Americans Living Paycheck to Paycheck

| Year (as of Jan) | Overall Population % | Necessity vs. Choice | Primary Driver |

| 2024 | 62% | 34% Necessity | Post-pandemic inflation peak |

| 2025 | 65% | 39% Necessity | Rising cost of “fixed” bills (Insurance, Utilities) |

| 2026 | 67% | 42% Necessity | “Resilience Paradox”: Exhausted savings buffers |

Quarter-by-Quarter Spending Patterns

Spending swings each quarter, driven by timing rather than recovery. Housing renewals, insurance resets, and seasonal costs shift spending, keeping budgets tight. Volatility defines the cycle, not relief.

We Guide People How To Invest In Real Estate

The Driving Forces Behind Financial Strain

Behind the statistics sit everyday pressures that chip away at monthly stability. These forces feel familiar because they hit week after week.

Rising Costs of Everyday Essentials

Core essentials absorb more income than before. Housing, groceries, and health care remain non-negotiable necessities, and each shows a steady increase in cost. For example, rent renewals often reset higher than expected, locking families into tighter margins.

Shock Expenses That Break the Budget

Unexpected medical bills and a sudden car repair still act as tipping points. It takes just one large bill to shift a household from balanced to financially stretched in a single month. We see this pattern repeatedly across millions of families.

Systemic Pressures on Weekly Paychecks

Small increases add up fast:

- Tariffs raise prices on everyday items like shoes

- Gasoline prices ripple into the weekly expenses tied to commuting

The “Barbell Effect” in Household Finances

A clear contrast stands out in today’s household finances. We call it the Barbell Effect—outcomes bunch up at the two extremes, with hardly any middle ground left.

On one end, higher-earning households sit pretty comfortable. They hold a solid account

balances and gain from rising asset values.

For instance, the top fifth of earners controls a huge chunk of corporate equities, often cited around 80-90% in recent analyses, which keeps their savings steady and softens monthly hits. Inflation nicks them too, sure, but reserves make the sting much lighter.

Notice how some folks weather price jumps without blinking? That’s usually the cushion talking.

On the flip side, most households scrape by. Data from 2026 points to the majority running minimal reserves, with balances dipping near zero month after month.

When costs climb, these families trim back hard or lean on credit just to cover the next six months. Millions feel it daily—paycheck in, essentials out, repeat. The split feels uneven. Growth stories in the news sound upbeat, yet for so many, income heads straight to basics.

The divide sticks around, no question. Practical note from tracking these patterns: small, consistent checks into a separate savings spot can start bridging that gap over time, even if it’s just a little each payday.

The 2026 American Barbell: Assets vs. Liquidity

| Household Tier | Equity Ownership (Stocks/Funds) | Emergency Savings ($1,000 Crisis) | Primary Financial State |

| Top 10% (High Resilience) | ~85.6% of all shares | Can pay with cash/savings | Asset-Rich: Growth outpaces inflation |

| Middle 40% (Shrinking) | ~14.1% of shares | Mix of savings and credit | Stagnant: Wages barely track costs |

| Bottom 50% (High Strain) | ~0.3% of shares | Must use credit, borrow, or skip bills | Liquidity-Poor: Minimal reserves |

Understanding the Percentage of Americans Living Paycheck to Paycheck in 2026

This year looks different, and the reasons extend beyond inflation headlines. The structure underneath household finances has shifted.

What 2026 Surveys Reveal

A national survey shows the percentage of Americans living paycheck to paycheck remains elevated despite stable employment. Consumers report less flexibility, even when wages rise.

As analysts at the America Institute have recently pointed out, income growth in America means little if a household lacks timing and liquidity.

You can earn a high salary, but if that money is immediately swallowed by necessities before your next paycheck arrives, you remain stuck in the living paycheck cycle. This ‘timing gap’ is why millions feel financially stretched despite seeing an increase in their hourly wages

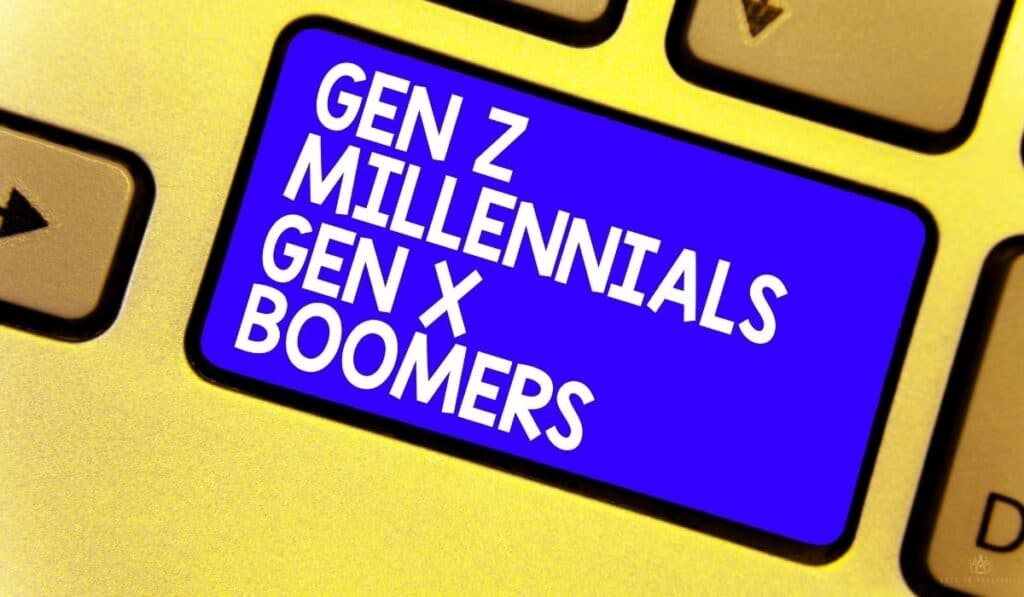

The Generational Divide

Gen X now reports the highest financial strain across any generation. Mortgage resets, tuition costs, and aging-parent care collide at once. Millennials and Gen Z face different pressures, yet fewer fixed obligations create slightly more adaptability.

The Six-Month Financial Outlook

Looking at the next six months, most households expect flat savings and cautious spending. The majority does not anticipate meaningful relief soon.

Banking Friction and Credit Access

Bank fees, overdrafts, and limited bank credit still matter. A single missed payment can drain an account, reducing access when families need it most.

What Percentage of Paycheck Goes to Taxes in 2026?

Before money ever reaches a bank account, taxes take a meaningful share. Understanding where that paycheck goes helps explain why cash feels tight even when wages rise.

Legislative Context for 2026

The One Big Beautiful Bill Act of 2025 locked in a permanent tax cut for many households. On paper, that sounds helpful. In practice, the benefit feels uneven once daily costs enter the picture.

How Taxes Reduce Take-Home Pay

Most workers see federal income tax, Social Security, and Medicare deducted before they are paid. For example, close to half of a raise often disappears through withholding, leaving less flexibility month to month.

The SALT Deduction Update

The SALT cap now sits at $40,000. That matters in high-tax states like New York, especially after January payroll resets.

Inflation as a Hidden Tax

Inflation quietly reduces what families can buy. Even unchanged bills feel heavier, leaving households stretched thin and financially pressured.

Net Worth by Age Percentile, and Retirement Readiness

Looking beyond income reveals why stress lingers. Net worth, not salary, shapes long-term stability and retirement confidence.

The Growing Savings Gap

A widening gap separates actual savings from long-term goals. Many households work longer hours, yet balances grow slowly over the years.

Emergency Savings Reality

A recent Bankrate study shows only about 30 percent of adults could cover a $1,000 emergency with cash. For instance, a single repair can erase months of careful saving.

Age-Based Net Worth Benchmarks

Gen X sits in a tougher spot than younger groups. Higher obligations collide with limited runway. Younger generations hold less wealth, yet fewer fixed costs allow flexibility.

2026 Net Worth Benchmarks by Age & Generation

| Generation | Age Bracket | Median Net Worth | Average Net Worth | Primary Financial Challenge |

| Gen Z | 18–28 | $12,000 | $86,000 | Entry-level wages vs. high rent |

| Millennials | 29–44 | $135,300 | $549,600 | “The Messy Middle”: Housing & childcare |

| Gen X | 45–60 | $246,700 | $1.13 Million | High obligations; limited retirement runway |

| Baby Boomers | 61–79 | $384,800 | $2.46 Million | Managing liquidity and healthcare costs |

Why Small Savings Still Matter

Small, steady progress compounds. Even modest deposits create a bigger buffer over time, supporting resilience rather than perfection.

Final Thoughts

The reality is clear. Americans are adjusting to a new way of living, where timing, costs, and expectations shape daily decisions. This moment does not call for panic. It calls for awareness.

For example, understanding how money moves through a household helps consumers stay grounded and adaptable. The current course of America’s economy rewards flexibility more than perfection.

Small shifts in perspective matter, especially when conditions stay uneven. If this analysis helped frame what is happening around you, explore more insights on our homepage. Staying informed remains one of the strongest tools households have right now.